Protecting Credit Union Deposits Since 1974

- No credit union member has ever lost money in any American Share-insured credit union account.

- American Share’s insured credit unions generally have little or no investments in mortgage-backed securities. American Share’s insured credit unions hold few or no sub-prime mortgages, as confirmed by our numerous on-site field examinations.

- American Share’s equity ratio is greater than that reported by both federal deposit insurance funds.

- The majority of American Share’s assets are held in cash and US government-guaranteed bonds and US Treasury securities. American Share does not hold the types of investments that plagued many financial institutions and investment firms in recent years.

- A “big four” accounting firm annually audits the company’s financial statements; and an independent actuary attests each year to the sufficiency of the company’s loss reserves.

- American Share’s only business is to provide deposit insurance to credit unions… and only credit unions. American Share is selective about the credit unions it insures. Not all credit unions that apply for coverage are accepted due to American Share’s strict underwriting standards. American Share-insured credit unions are examined regularly.

- American Share is licensed by the Ohio Department of Insurance and dual-regulated by the Ohio Departments of Insurance and Commerce.

- American Share has always been and continues to be in good standing with the various insurance departments and regulators in all of its states of operation.

- American Share is not assigned an insurance industry rating by A.M. Best due to American Share’s unique structure as a mutual share guaranty corporation as opposed to a traditional insurance company. Financial data and other information are supplied to rating services for their review and analysis.

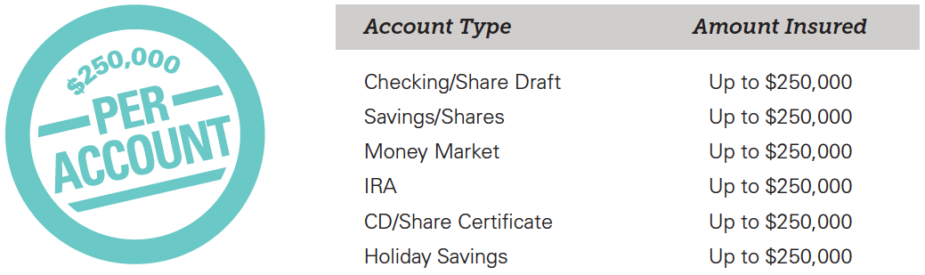

American Share insures each and every account of an individual member up to $250,000, without limits as to the number of accounts held. If you have 20 separate accounts with your credit union, up to $5,000,000 of your deposits are covered!

BY MEMBERS’ CHOICE, THIS INSTITUTION IS NOT FEDERALLY INSURED. MEMBERS’ ACCOUNTS ARE NOT INSURED OR GUARANTEED BY ANY GOVERNMENT OR GOVERNMENT-SPONS0RED AGENCY.

American Share is a member-owned, private share insurer founded in 1974 and is owned by its insured credit unions. Currently, the corporation insures the accounts of over 1.2 million credit union members. If you have questions about the coverage provided by American Share, ask your credit union or contact us at 800.521.6342.

COMMONLY ASKED QUESTIONS ABOUT YOUR SHARE INSURANCE

Q: I see that our credit union recently changed its name and the program that insures its members’ deposits, why was this done, and who made this decision?

A: Up until June 1, 2016, your credit union was federally chartered by the National Credit Union Administration (NCUA) out of Washington, DC, and federally insured by a federal share (deposit) insurance fund called the National Credit Union Share Insurance Fund (NCUSIF), which is administered by the same regulator, NCUA. For reasons noted below, and after careful due diligence, the credit union’s member-elected volunteer board of directors unanimously resolved to change the credit union’s charter to that of a California state-charter, and to apply for non-federal (private) share insurance from the nation’s only alternative to the NCUSIF, American Mutual Share Insurance Corporation (ASI or American Share). ASI is an Ohio-licensed share guaranty corporation that insures the shares of state-chartered credit unions. [Note: The change in charter requires we drop the word “federal” from our legal name.]

This proposition was presented via the mail to the entire credit union membership in late November 2015, and over a 30-day period, over 3,369 of our 10,669 members voted on this dual change, with 71.4% of those voting, voting in favor to that change in the final accounting. The support was overwhelming. This member supported change became effective June 1, 2016.

Q: What was the reasoning behind changing from a federal to a state charter, and from federal to private share insurance?

A: The reasons for these changes stemmed from:

- the federal regulator limiting our investment authority and in turn our ability to earn at a level needed to properly serve and reward our members;

- regulatory fees at the federal level almost double that charged by the state credit union regulator;

- need for broader coverage provided by the private share insurer, GASCU can now insure more members for less; and,

- the fact that being state-chartered allows the credit union to work with a regulator that understands local and state-level issues, often dismissed by federal agencies focused on Washington DC.

Q: Is ASI’s coverage different from that afforded by the federal fund?

A: Yes. Under ASI’s coverage, each and every account of an individual member is insured to $250,000, irrespective of the number of total accounts that member holds with the credit union. The federal program insures each member to $250,000 for the sum of all their basic accounts; such as: regular shares, money market account, certificates of deposits and share drafts (checking). [For more information on ASI’s coverage go to http://www.americanshare.com/consumer-overview/ ]

This broader coverage allows GASCU to offer its members a substantially greater base of coverage, protecting almost all of the approximately $22 million in member deposits previously uninsured under the federal program.

Q: How long has American Share Insurance been operating and how long have they been operating in California?

A: American Share was chartered in May 1974, just three years after share insurance was first offered to federally chartered credit unions through the NCUSIF. The company was approved by the California Department of Corporations to provide California state-chartered credit unions primary share insurance on January 29, 1982.

Q: In what other states does American Share Insurance provide such protection to credit union members? And, how long have they been providing this coverage in these respective states?

A: American Share has insured state-chartered credit unions in the following states for the noted number of years:

Alabama (19 yrs.), Idaho (33 yrs.); Indiana (33 yrs.); Illinois (35 yrs.); Maryland (14 yrs.); Nevada (34 yrs.); Ohio (42 yrs.); and, Texas (10 yrs.).

Q: How many credit unions does American Share provide share insurance protection to, and who are the California credit unions they insure?

A: American Share Insures 124 state-chartered credit unions in nine states nationally, including 13 of California’s 143 state-chartered credit unions as of June 30, 2016; the list of California insured credit unions follows:

| CU Name | City | Total Assets

06/30/16 |

Approximate No. of Regular Share Accounts | Insured Since |

| C.A.H.P. Credit Union | Sacramento | $ 165,939,415 | 15,182 | 01/01/85 |

| Christian Community Credit Union | San Dimas | $ 642,286,900 | 31,400 | 01/29/99 |

| El Monte Community Credit Union | El Monte | $ 26,304,100 | 3,825 | 01/01/85 |

| Firefighters First Credit Union | Los Angeles | $ 1,092,502,100 | 35,401 | 09/13/84 |

| Fiscal Credit Union | Glendale | $ 141,214,674 | 14,271 | 04/02/02 |

| Fresno Police Department Credit Union | Fresno | $ 49,772,278 | 3,102 | 02/28/13 |

| Glendale Area Schools Credit Union | Glendale | $ 343,460,710 | 11,498 | 06/01/16 |

| Mid-Cities Credit Union | Compton | $ 22,612,157 | 4,665 | 12/24/84 |

| Monterey Credit Union | Monterey | $ 225,543,831 | 18,886 | 08/30/99 |

| PostCity Financial Credit Union | Long Beach | $ 74,469,579 | 7,548 | 04/25/84 |

| SafeAmerica Credit Union | Pleasanton | $ 410,318,708 | 32,837 | 12/28/09 |

| San Francisco Fire Credit Union | San Francisco | $ 1,171,621,724 | 61,335 | 05/01/99 |

| South Bay Credit Union | Redondo Beach | $ 88,683,546 | 7,309 | 08/31/84 |

Q: How well capitalized is American Share, and how does this compare to that of the federal share insurer, the National Credit Union Share Insurance Fund administered by the National Credit Union Administration (NCUA)?

A: At year-end 2015, American Share Insurance’s equity ratio was 1.70%, which is significantly greater than that reported by the NCUSIF, or 1.29%. In comparison, the federal insurance fund for all banks reported an equity ratio of approximately 1.15%.

Q: Who owns American Share Insurance?

A: Unlike the NCUSIF, and more like credit unions, ASI is a mutual insurer, and owned by the credit unions it insures. The company is authorized and dual-regulated by the Ohio Departments of Commerce and Insurance, and licensed by the Ohio Department of Insurance. The company is further approved as a provider of primary share insurance by the California Department of Business Oversight.

Q: How does the private fund at ASI compare or differ from that provided through the NCUSIF?

A: Like the NCUSIF, all sources of loss funding and revenues for ASI are derived from a deposit placed by the insured credit union with the insurance fund. The NCUSIF assesses an at-risk capitalization contribution equal to 1% of the credit union’s total insured shares, adjusted periodically (not less than annually), and their insured credit unions have no legal ownership in the fund which is managed by the same federal agency that regulates federally chartered credit unions – the National Credit Union Administration (NCUA).

Note: The NCUA/NCUSIF structure is similar to the one used for the failed Federal Savings and Loan Insurance Corporation (FSLIC) that cost all taxpayers over $300 billion in the late 1980s.

Both NCUA and ASI have the right and obligation to assess their insured credit unions additional periodic fees (premiums) when losses to the fund occur and the equity position is reduced below specific benchmarks. Under federal law, the NCUSIF has a legal responsibility to recapitalize itself on the backs of its insured credit unions before seeking a taxpayer’s bailout, functioning exactly like any mutual insurer (such as ASI), and the NCUA must exhaust its total capital and the total capital of all of its insured credit unions before seeking a taxpayer bailout. This has never happened.

Since the Great Depression, the FDIC has never sought a taxpayer bailout, and all of its losses during difficult economies have been paid by its insured banks through increased annual premiums. Since its start in 1971, the NCUSIF has never sought, or received, a taxpayer bailout, but it did have to assess all of its insured credit unions an amount that almost equaled their respective 1.0% deposits with the NCUSIF over a five-year period (2009-2013).

ASI has been operating since 1974 and no member in an ASI-insured credit union has ever lost a dime of their insured savings over those 42 years. During the years 2009-2013, ASI, however, did have to assess its members a special premium to survive the worst economy in the history of credit unions, but at a much lesser cost to its insured credit unions than that charged by the NCUSIF. GASCU spent over $300,000 more to be federally insured in the year 2009-2013.

Q: Does ASI have to insure every credit union that applies for its coverage?

A: No. American Share has strict underwriting standards, and as a private company it does not have to insure all applicant credit unions, especially those that fail to satisfy ASI’s membership standards.

Q: How does American Share monitor its insured credit unions?

A: Every insured credit union under our primary insurance coverage is monitored off-site monthly or quarterly, and ASI’s team of qualified examiners conduct onsite examinations of insured credit unions that represent over 90% of their total insured risk annually. This aids tremendously in identifying risks early and efficiently. Improving the financial strength of the private fund.